Jul 15, 2022

Afinum records a total of ten transactions in the first half of 2022

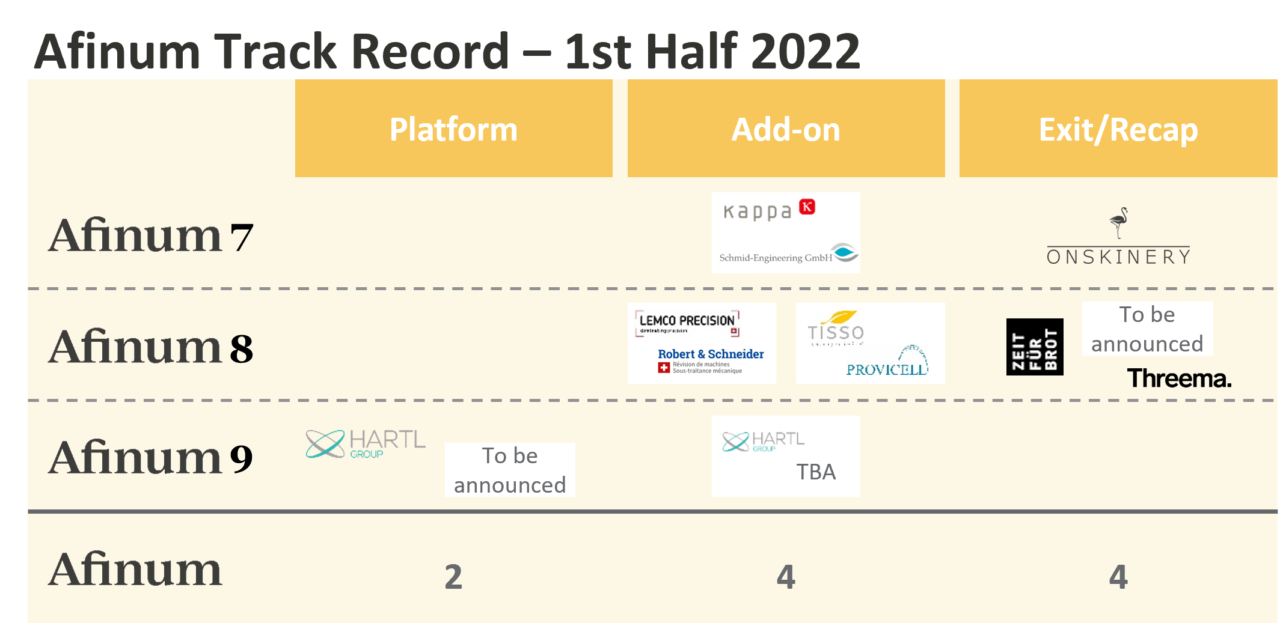

Another two platform investments for the new fund “Afinum 9” as well as four strategic add-ons and four distributions across the portfolio

Despite the current political and economic challenges, Afinum looks back on a highly successful first half of 2022.

With Afinum 9, the next generation of funds was launched at the end of 2021 and the team already closed two new platform investments with Fishing-King and GS Swiss PCB in the same year. In May 2022, the portfolio was extended by Hartl Group, a provider of managed cloud services with its own data center certified to the highest standards and realizing high energy efficiency ratings. The first add-on acquisition for Hartl Group was signed only two months after the initial transaction. Various add-ons for other portfolio companies are in advanced stages of due diligence. The Afinum team is also working on further platform investments and expects to close further investments by the end of the year due to strong pipeline of investment opportunities. Thus, Afinum 9’s investment ratio is expected to increase to above 40% by year-end. One new platform transaction has already been signed and one is in advanced due diligence.

The development of the “Afinum 7” and “Afinum 8” fund generations has also also bee4n significantly enhanced through acquisitions and distributions.

The portfolio company Lemco Précision acquired a participation in Robert & Schneider SA in July to strengthen its machine retrofitting expertise. The company specializes in retrofitting high-speed lathes. Lemco Précision is currently in exclusive negotiations with another add-on. With the acquisition of Provicell GmbH, the natural healthcare specialist Tisso succeeded in entering the veterinary market in June. In the same month, Kappa Optronics deepened its technology focus with the acquisition of Schmid Engineering GmbH.

In addition to new investments, Afinum was able to distribute significant funds to investors despite the challenging market environment. Investors of Afinum 7 received a significant distribution at the beginning of July 2022 due to the successfully realized refinancing at ONSKINERY. Through refinancings of Threema, Zeit für Brot and another investment – closing expected by end of July – the investors will receive a significant repayment within the coming weeks. Further capital returns through exits and refinancings are envisioned for the second half of 2022, with one exit of an Afinum 8 portfolio company already signed.

To support Afinum’s steady growth, we welcomed two new team members in July: Mischa Graf, Analyst in the Zurich office and Marton Lotz, Associate in the Munich office.

Contact

- Sabine Arnold

- Afinum Management GmbH

- Theatinerstraße 7

D-80333 München

Dr. Thomas Bühler to join the Supervisory Board of Afinum

Apr 17, 2024

As part of the ongoing implementation of management succession at Afinum Management GmbH, one of the co-founders, transitions to the Supervisory Board.

Learn more

Afinum 9 invests in PROLOGA Group, a leading software player in the SAP partner universe with a focus on the circular economy as well as the utilities industry

Feb 29, 2024

Afinum 9 invests in PROLOGA Group (“PROLOGA”), a leading software provider of SAP add-on solutions with a focus on enterprise customers within the circular economy and utilities industry. This acquisition represents the ninth platform of the Afinum 9 fund as well as the second thematic investment in an SAP partner and a vertical industry champion, following the investment into mymediset, the leading cloud platform for medical devices supply chain in February 2023. It further underlines the fund’s and the Afinum team’s commitment to empowering businesses in impact industries.

Learn more

From entrepreneur to entrepreneur

Get in contact

e-mail

phone