Entrepreneurial. Empathic. Consciously engaged.

We are Afinum -

We are Afinum -

successful for many years and experienced across most industries.

As a German investment firm, we have been shaping succession situations for SMEs for more than 20 years: respectful, strategic and far-sighted.

With the ambition to make good things even better, today we strengthen and develop leading companies for tomorrow.

Our investment approach puts people first, because we believe that people in a company are the most valuable asset.

"Afinum is the perfect partner for FISHING BASE with its sustainable investment approach and strategic know-how in the further development of our business models.

The partnership allows us to achieve our strategic goals in a sustainable way."

Results in numbers

Afinum at a glance

~80

transactions

in the last 20 years

1,4

EUR bn.

capital commitments overall

90%

of the firms

acquired from entrepreneurs

7

fund-generations

since the incorporation of Afinum

Afinum’s access to experts and also the strong network between portfolio companies, has been an amazing support for me.

Broad sector experience

The current Afinum portfolio

Afinum invests industry agnostic. We believe that – with the right team – value creation potential can be developed and increased in most of the sectors and portfolio companies .

Mymediset

SAP-integrated loan and consignment management software

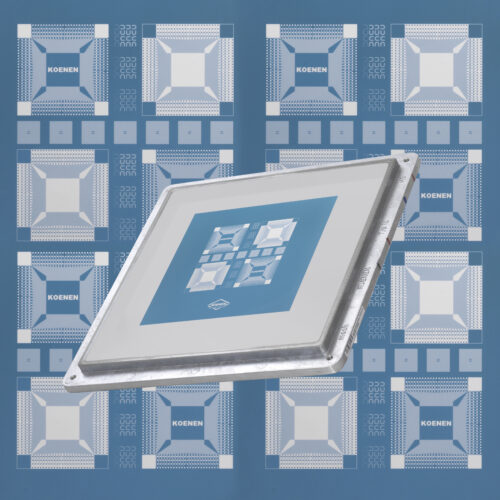

Christian Koenen Group

High-precision premium stencils and screens for technical printing

synaforce

Leading provider of “managed cloud services” with state-of-the-art and highly energy efficient infrastructure

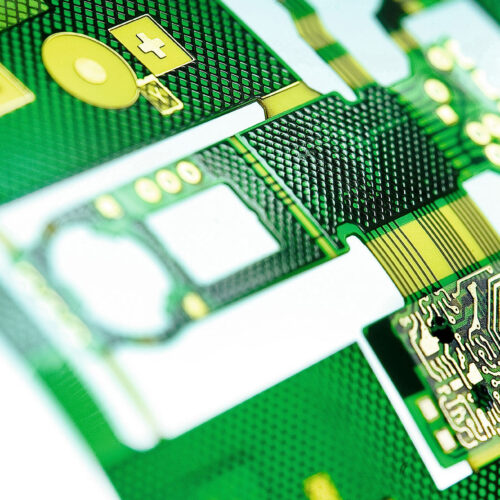

STG Swiss Technology Group AG

Specialized provider of highly miniaturized PCBs with highest reliability requirements

Tisso Naturprodukte GmbH

Specialized manufacturer and premium brand for therapeutic nutritional supplements

News

News from Afinum

Dr. Thomas Bühler to join the Supervisory Board of Afinum

Afinum 9 invests in PROLOGA Group, a leading software player in the SAP partner universe with a focus on the circular economy as well as the utilities industry

Afinum sells its majority stake in Iconia to Deutsche Invest

Dr. Thomas Bühler to join the Supervisory Board of Afinum

Apr 17, 2024

As part of the ongoing implementation of management succession at Afinum Management GmbH, one of the co-founders, transitions to the Supervisory Board.

Learn more

Afinum 9 invests in PROLOGA Group, a leading software player in the SAP partner universe with a focus on the circular economy as well as the utilities industry

Feb 29, 2024

Afinum 9 invests in PROLOGA Group (“PROLOGA”), a leading software provider of SAP add-on solutions with a focus on enterprise customers within the circular economy and utilities industry. This acquisition represents the ninth platform of the Afinum 9 fund as well as the second thematic investment in an SAP partner and a vertical industry champion, following the investment into mymediset, the leading cloud platform for medical devices supply chain in February 2023. It further underlines the fund’s and the Afinum team’s commitment to empowering businesses in impact industries.

Learn more

Afinum sells its majority stake in Iconia to Deutsche Invest

Feb 9, 2024

Following a successful growth path, Afinum 7 sells its investment in Iconia to funds advised by private equity investor Deutsche Invest. During Afinum’s holding period, Iconia expanded its market position and developed from a well-recognized display provider to the leading European full-service provider of interior architecture, display, and packaging solutions for iconic luxury brands. Today, the Group employs about 420 employees and is present in Switzerland (Freienbach, Lausanne), Italy (Torino, Veggiano), China (Dongguan) and Singapore.

Learn more

From entrepreneur to entrepreneur

Get in contact

e-mail

phone